AI-powered forecasting enables systematic fundamental analysis across thousands of companies

AI-powered forecasting enables systematic fundamental analysis across thousands of companies

I've been working on forecasting for the last 6 years, starting in Waymo predicting collision metrics, then at Google predicting tech outcomes, then at Metaculus predicting AI timelines, and the last 2 years at FutureSearch predicting everything at scale. People ask me all the time: can you forecast stock prices?

Until now, my answer has been: No, because stocks are traded in a market. Prices already reflect the wisdom of the crowd. The stock market is a kind of prediction market on future cashflows, after all.

Now, my answer is: Yes. AI forecasting is competitive with human forecasting. And we've found a way to apply forecasting techniques to the stock market. We call it Stockfisher, it's live for everyone at stockfisher.app.

Value Investing's 50-Year Dream

Rewind 50 years to 1975. Warren Buffett has been chairman of Berkshire Hathaway for 5 years; Peter Lynch just became director of research at Fidelity. Value investing is being born.

Those who accurately value companies by fundamentals will make some of the most spectactular returns in modern investing history.

This approach is gospel now. Every MBA and Finance 101 course teaches that, in the long term, the value of companies is tied to long-term discounted cashflows to shareholders, which can be derived from revenues, margins, and payout ratios.

But how do you predict revenues, margins, and payout ratios? A whole generation has tried to emulate the Oracle from Omaha. For decades people would read 10-Ks and use their poorly calibrated judgment.

The art and science of forecasting was in the dark ages though, until 2015 when Tetlock published Superforecasting. And then in 2022 came LLMs that could actually "understand" companies.

Judgmental Forecasting and LLMs

Judgmental forecasting alone didn't crack it. Several superforecasters I know have worked at hedge funds. Mostly they trade on Polymarket, which even with recent growth is a tiny minnow compared to whales of larger financial securities like stocks.

LLMs alone didn't crack it. It's just obvious that LLMs, even the good ones of 2025, even with web search, do not have the judgment of expert humans, and their mistake rate is too high, between hallucinations, and just bad deductions that wreck the value of the good ones.

Together, though?

The Long-Term

One key to getting LLM-powered judgmental forecasting working for stocks was to focus as much on the long-term as possible.

First of all, in the short-term, it's hard to claim any humans, HFT, or quant systems actually beat the market. Or if they do, they don't for long. Stock prices reflect market psychology, momentum, and countless other factors that baffle the top hedge funds, not just LLMs.

But in the long term, company value comes down to cashflows to shareholders. Long-term buy & hold investing does perform extremely well on average. And to do that well, you need long-term forecasts of revenues, margins, and payout ratios. We think we can forecast those well enough.

The Whole Market

That's not enough though. It's a huge market out there.

This is where LLMs really shine. Once you have a full agentic workflow, tuned against forecasting and research benchmarks, to exhaustively research companies to understand their fundamentals, you need to do this for every company to find the best returns.

It's a staggering amount of research. For us, at least $10k for a one-time analysis of the S&P 500. It would take expert human analysts at least 1,000 hours to replicate this.

But the LLMs are consistent. Yes, they have weaknesses humans don't have. But the humans have weaknesses the LLMs don't have. Most obviously, no one human can research every company. Which means you're always comparing views across a whole group of humans with different biases and motivations.

To find the best value, you need to analyze the entire market systematically. This, as a friend puts it, is "qualitative research and quantitative scale". This is for LLMs, not humans.

Qualitative and Quantitative

You can't understand companies without reasoning qualitatively. Is this new project in their filings on track? How credible is what this manager is saying in this earnings call? Does this 10-K segment analysis make sense given recent trends?

Last generation's ML could only do simple sentiment analysis, or flag keywords. Fine for high frequency trading. Not good enough for modeling actual company valuations.

Stockfisher: Putting it All Together

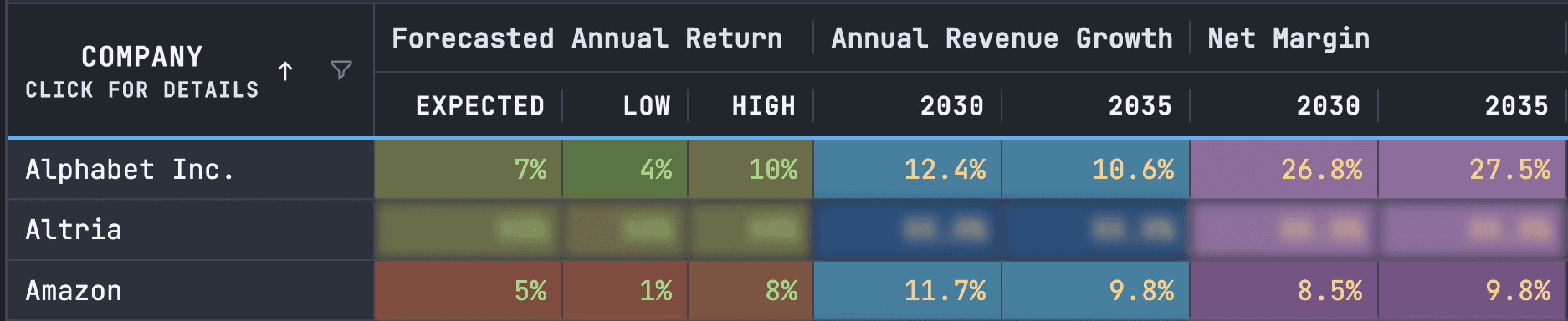

So this is what we've done. We've taken our expertise in judgmental forecasting, tuned LLM agents to be as accurate as possible on our research and forecasting benchmarks (see Deep Research Bench and Bench To the Future), carefully studied how to structure fundamental company research, and build a scaled system to research every company to a stupefying level of detail.

How good is the output? You have to judge for yourself.

One finding I'll highlight here. One thing about forecasting I have studied at Google, Metaculus, and now FutureSearch is: does accurate forecasting come more from better research, or better judgment?

Top forecasters—human or AI!—need excellent research. If you don't find the facts on the ground, like when a senate committee is meeting, or the specific charges in a lawsuit, or the details of how a new technology works, you're hosed.

But top forecasters also need excellent judgment. How do you weigh conflicting evidence? What are good priors and updates? What are good causal models of how the world actually works?

In long-term fundamental stock forecasting, we have a tentative answer: good accuracy comes mostly from research. Of the hundreds of millions of tokens used to process all the research in the S&P 500, the good majority go to researching the present day, not reasoning about the future.

Again, you can judge the results for yourself at stockfisher.app. You can see the conclusions for the top 50 companies for free, no sign in required.