We all know the US stock market has been acting strangely. In 2020, I was in the camp that thought a global pandemic would hurt stocks, not help. Since then I have not felt at all good about timing the short-term wonkiness of the market.

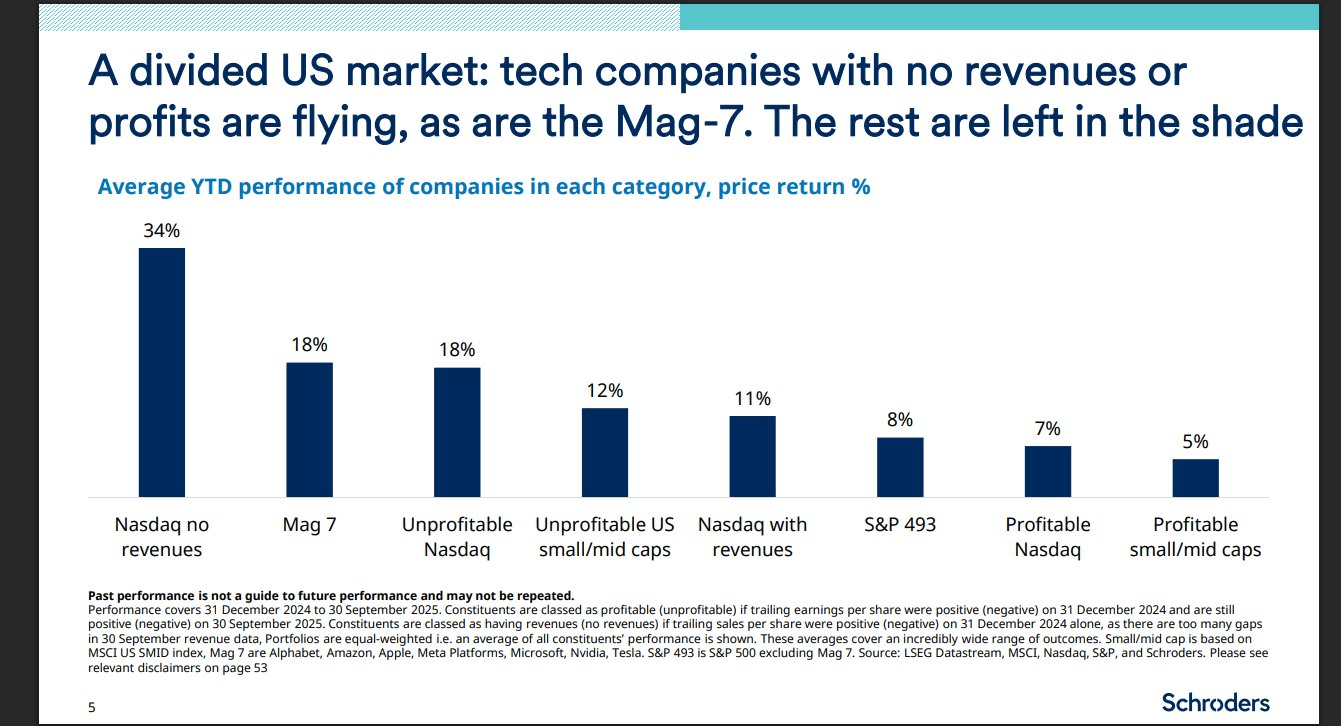

And now there's this:

I'm a technologist who fundamentally believes that tech is the driving force of humanity, and thereby markets. I bought Google, Tesla, others in the roaring 2010's based on a dream, and that dream came true, before I got spooked in 2020 with the pandemic and closed out most of my positions.

This, however, looks too strange. And with market strangeness comes opportunity. (This is not investment advice.)

The more that the stock market diverges from the fundamental value of companies, the more that buying based on earnings, margins, and cashflows becomes a differentiated signal.

What was gospel 50 years ago now looks like a niche, undervalued source of diversified alpha!

The trouble is, of course, how do you actually value companies based on their fundamentals? It's not good enough to see earnings, margins, and cashflows today. You need to predict how they will change over 5-10+ years. And you need to do this for every company.

Until now, fintech and AI have just not been useful to value investors, who have been living in the "spend all day reading 10k filings" world.

Put simply, the world of stock tools and sell-side research doesn't serve value investors. First, they focus on the next quarter or year. Value investing is about long-term cashflows over 5-10+ years. But most research, ratings, and price targets focus on next quarter's earnings or next year's performance. This fundamentally misses what drives long-term returns.

Second, they don't cover all publicly traded stocks. Selective coverage introduces bias. Analysts cover popular stocks, large caps, or companies their firms have relationships with. If you want to find genuine undervaluation, you need to analyze the entire market systematically, not just the companies that happen to get analyst attention.

Third, they focus on earnings or industry multiples instead of cashflows. Finance 101 teaches that company value comes from discounted future cashflows. But most tools focus on P/E ratios, EV/EBITDA multiples, or relative valuations within industries. These shortcuts miss the fundamental question: what cashflows will this company actually generate for shareholders over the next decade?

Fourth, and maybe most importantly, they have incentives other than pure forecast accuracy.

Sell-side analysts work for banks that want investment banking relationships. Fintech platforms want subscriptions and engagement. Nobody is purely incentivized to get long-term fundamental forecasts right. This misalignment means their analysis can't be fully trusted for value investing decisions.

Fintech hasn't addressed any of these points. Yes, high-frequency tools and time-series models are widely used at hedge funds. But what tools do retail investors have that actually help them predict long-term company fundamentals?

This is why we built Stockfisher. At FutureSearch we confront forecasting problems head on.

For the last two years, we've been studying how to actually get hard questions right. Now we're putting our best research and forecasting techniques to the test in the most competitive forecasting game in the world.

Time will tell whether we're more accurate than the experts. (Our track record and our evals on research and forecasting benchmarks speak for itself.)

But even before 5 years pass, and we find out whether FutureSearch's 5-year forecasts beat the market, there is something fundamentally different between AI analysis and human analysis.

First of all, Stockfisher doesn't have the bias that any number of stock analysts have. We analyze every company, so we have no incentive to hype up any particular company. We want the best value, and being objective is the best way to find it.

But more importantly, it's consistent. Just like last decade's ML models treat every input the same, our qualitative research treats every company the same.

It's the first time that qualitative analysis can be done completely consistently. And we have a number of robustness checks in place too.

Consistency in quantitative reasoning is easy. Consistency in qualitative reasoning is new. This is what FutureSearch enables. And when applied to stocks, the output is completely different than any stock analysis ever done before.

FutureSearch is all about applying reliable research and forecasting at scale. The stock market has that scale.

And when you look at deeply researched forecasted returns of every company, using tried-and-true, old-fashioned, Buffett-style methods, the results are full of surprises. And surprises are what I want as an investor.

Our conclusions for the top 50 companies are public and free, with no sign-in required, at stockfisher.app. Decide for yourself whether you think we've cracked fundamental stock analysis.